SAS Online Review:

Pros

- One of the Cheapeat brokerage fees (Rs 9/trade)

- Availability of monthly unlimited plans for fixed price

- Margin against shares is available

- Free tools like Span Margin Calculator and Brokerage Calculator

Cons

- No Support for IPO and Mutual funds investments

- No Support for NRI Tradingt

In this review of SAS Online discount broker, we shall learn more about the broker in terms of their brokerage charges, trading platforms, account opening charges and customer service etc.

About SAS Online:

SASOnline started its operation relatively late compared to Zerodha.

It was founded in 2013 by three young people, Shrey Jain, Siddhanth Jain and Anubha.

It claims to have 10000+ clients across 700+ cities.

This broker received NSDL Best performer award for 2015 – rising DP.

They have does a daily average turnover of more than Rs 6000 crores

One can trade in following segments through them,

- Equity

- Derivatives

- Currency

- Commodities

They got membership with MCX during October 2014. Due to reduced brokerage charges, they are able to acquired good number of customers and have emerged as one of the top discount broker of India having online presence.

SAS Online Customer Ratings & Review 2024:

| SAS Online Customer Ratings | |

|---|---|

| Brokerage Charges & Fees | 9.70/10 |

| Trading Platforms | 9.22/10 |

| Products & Services | 8.9/10 |

| Experience | 8.8/10 |

| Overall Ratings | 9.01/10 |

| Star Ratings | ★★★★ |

In my view SAS Online is best for.

- Who is looking for lowest brokerage charges

- Traders interesed in monthly brokerage plans

- Online account opening

SASOnline Brokerage Charges:

In my opinion, probably SASOnline charges one of the cheapest brokerage as far as flat fee brokers are considered.

SAS Online Brokerage Details:

SAS Online is one of the very few stock brokers who offer monthly brokerage plans for unlimited trading. You can either choose flat Rs9/trade plan or monthly plan.

You can change the brokerage plans at anytime. Please note that Rs999 is charged seperatly for each segment.

Account Opening Charges:

- Trading Account opening charges: Rs 200 (One time)

- Demat Account opening charges: Rs 200

- Trading Account Annual Maintenance charges:NIL

- Demat Account Annual Maintenance charges: NIL for first year and Rs 300 from second year onwards.

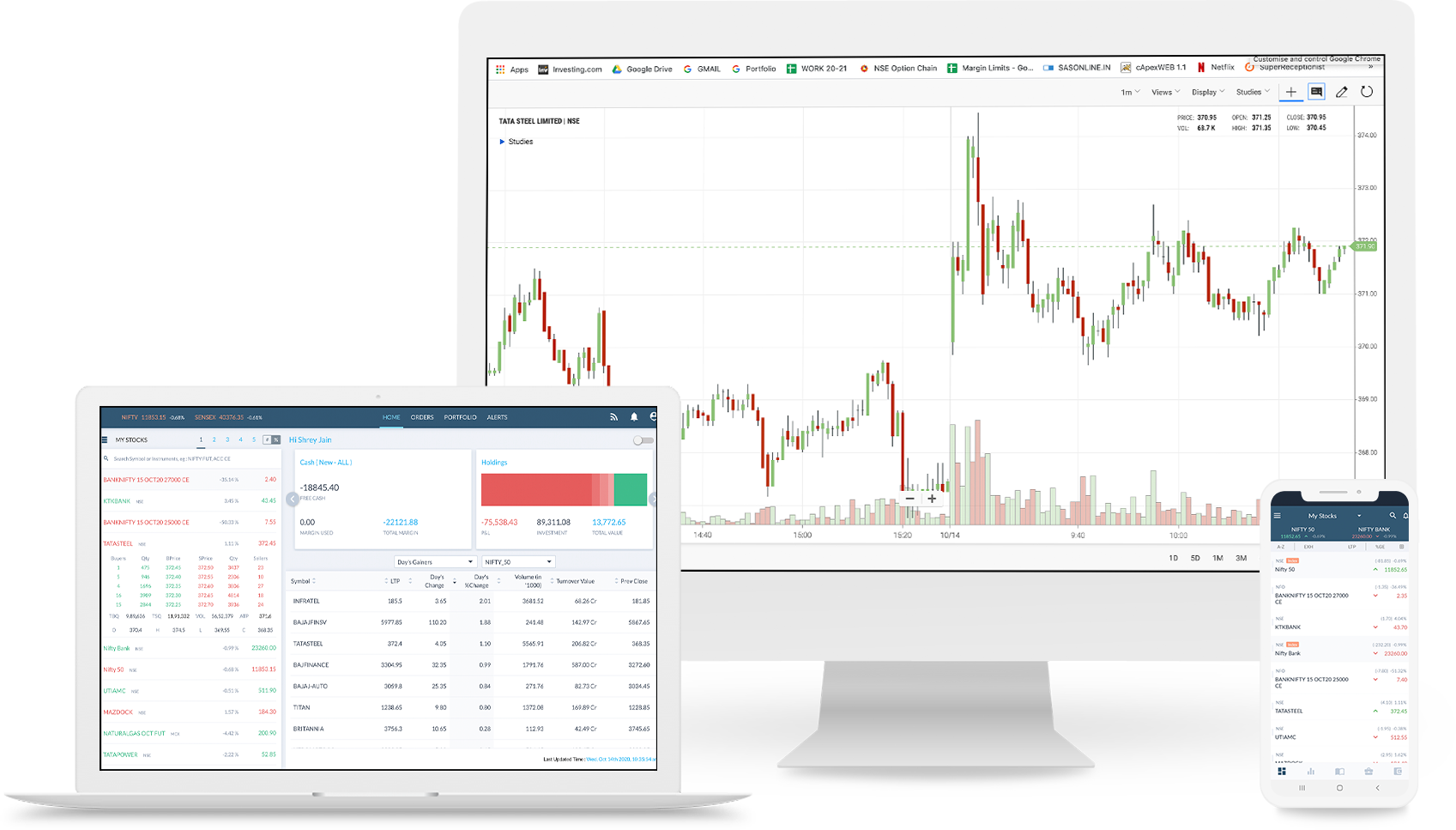

SAS Online trading Platforms

Like all other brokers, they offer trading platforms across all the devices, namely desktop, mobile and web.

Aplha is their flagship trading platform for all platforms. They also provide NEST platform which is from Omnesys technologies..

Related Read : 9 Best Trading Apps of India for Quick Trading

SAS Online Trader:

It is a desktop based application which has to be installed in desktop. It is particularly useful for the day trades to punch quick orders.

Check out the intraoduction to Alpha trader in the video below.

SASOnline Web HTML 5

It is a cloud based browser and you dont have to install any software. It is run using any one of the web browser and hence can be accessed from anywhere.

It is compatible with most of the present day browsers.

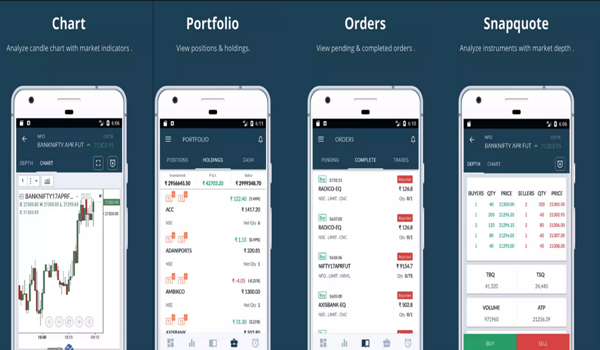

SAS Online Mobile App

Best suited for the traders on the move. It is available on Android, Windows and iOS platforms.

One can do trading and as well as fund transfer using the app.

The app is loaded with many features like finding hot stocks with market screeners eg. Volume Shockers,52 Week High/low breakers,Most Active Stocks etc.

Apart from the above platforms, they also provide access to NEST Trader which is a third party software.

SAS Online In Comparison With Other Brokers:

Check out how SAS online fares when compared with other prominent stock brokers of India. Click on the stok brokers to see the side by side comparison of SAS Online with that particular stock broker.

SASOnline in comparison with other Stock Brokers |

||

SAS Online Contact Details:

- Website: SAS Online Website

- Email: support@sasonline.com

- Phone: +91-11-40409999

- Address: 3rd Floor, Building No 5, Local Shopping Complex, Rishab Vihar, East Delhi – 110092

Advantages and Disadvantages of SAS Online:

Following are the some Pros and Cons which I can list down for SASonline,

Disadvantages:

- No Support for NRI Trading

- No Support for IPO and Mutual funds investments

Advantages:

- One of the Cheapeat brokerage fees (Rs 9/trade)

- Availability of monthly unlimited plans for fixed price

- Margin against shares is available

- Free tools like Span Margin Calculator and Brokerage Calculators

SAS Online Review – Conclusion :

The brokerage company is targeting the traders who are interested in saving more bucks through brokerage charges.

While the brokerage charges is one of the lowest with them, they have fixed a high transaction charges compared to other brokers, hence in some cases they become expensive than other brokers.

The monthly brokerage plans might be useful for traders who trade very frequently.

If you already have account with SAS Online, please share your review and ratings through comments below.

You May Be Also Interested In: